Inside Beauty’s Biggest Acquisitions of 2025

Table of Contents

This year, two blockbuster beauty deals happened – Medik8 and Rhode.

Both clocked in at around the $1-billion mark, both made headlines across beauty and finance circles. And, apart from being very fun to watch from the sidelines, they both said something much larger about where the industry is going.

These weren’t hype-driven blips or influencer cash-outs. They were billion-dollar case studies for how modern beauty brands can scale, survive, and sell. Yes, despite the deal sizes, even if they don’t have a famous founder or millions of dollars to spend.

Now that the dust has settled, let’s look at the biggest acquisitions of 2025 and what they mean for all the ambitious beauty brands out there.

2025: The Year of Major Beauty Acquisitions

2024 was a reset year for beauty. The deal flow slowed to a trickle because inflation, high interest rates, and shaky valuations cooled investor appetite.

Gone were the days when conglomerates would buy anything that moved on TikTok. Remember the era when a viral serum or influencer brand could spark a bidding war overnight? Those deals didn’t age well.

Take Coty’s $1.2 billion Kylie Cosmetics gamble as an example – it fizzled as sales cooled. Addison Rae’s Item Beauty disappeared from Ulta’s shelves almost as quickly as it arrived. Even Selfless by Hyram, once a Gen Z skincare sensation, was quietly discontinued.

Source: Ulta Beauty

The lesson? Virality doesn’t equal viability. Hype burns fast, but margins, credibility, and repeat purchases are what actually sell.

That’s why 2025 looks so different. L’Oréal didn’t buy Medik8 for clout, and e.l.f. didn’t acquire Rhode just for its followers. They bought performance or, in other words, brands that had already proven demand, profitability, and loyalty.

2025 deals were sharper, more strategic, and focused on credibility.

Rhode → Acquired by e.l.f. Beauty for roughly $1 billion

Medik8 → Majority stake purchased by L’Oréal at a similar valuation

Dr. Squatch → Snapped up by Unilever for an estimated $1.5 billion

Beauty Tech Group (Current Body, ZIIP, Tria) → Pulled off one of the only successful consumer IPOs of the year

Very different brands. Very different stories. But they share one thing – the smartest money is going where the fundamentals are strong and the brand story is real.

Speed vs. Stamina

Let’s dig deep into the Rhode and Medik8 acquisition! The brands themselves couldn’t be more different if they tried.

Rhode was built in public. Fast, flashy, and founder-famous. Hailey Bieber launched it in 2022 with a social media mastery that had every Gen Z creator copying her routine. Three years later, she sold it for a billion dollars.

Medik8, on the other hand, took sixteen years to get there. No viral drops, no celebrity founder. The brand is built on rock-solid formulas, slow compounding, and a cult following of dermatologists and people who are truly obsessed with skincare.

One brand sprinted. The other took its time. Both won in the end.

That’s the lesson: there’s more than one way to build a billion-dollar beauty brand. The market doesn’t care how long it takes, as long as you can prove three things:

People actually buy your products.

You protect your margins.

Your brand means something.

What’s more, each 2025 deal filled a strategic, not a revenue gap.

e.l.f. × Rhode: e.l.f. wanted to stay the number-one Gen Z brand. Rhode gave them Gen Alpha and prestige cachet.

L’Oréal × Medik8: L’Oréal doubled down on its “derm-meets-luxury” portfolio alongside Aesop, Skinceuticals, and Skinbetter Science.

Unilever × Dr Squatch: A straight-up replacement for Axe – modern, funny, and proudly masculine.

When L’Oréal’s Luxe president Cyril Chapuy announced the Medik8 deal, he didn’t talk about growth targets or social virality. He said: “We share a strong belief in Medik8’s global potential.” Translation: this brand has staying power, not just hype.

The Economics Behind the Scenes

As with all acquisitions, behind all the media coverage and industry excitement is a spreadsheet full of margins.

Few people break those numbers down better than Drew Fallon, the finance mind behind “Making Cents”. All financial figures in this piece are sourced from his analyses: “Medik8 Acquired by L’Oréal for $1B+” and “Rhode Acquired for $1B by e.l.f.”

Let’s start with Medik8. Fallon’s June 2025 analysis estimated that L’Oréal paid roughly nine times Medik8’s annual revenue – nearly $1 billion for a brand generating just over $100 million in sales.

Source: Making Cents, Iris

Private-equity firm Inflexion had bought Medik8 in 2021 for $233 million when the brand was generating about $30 million in annual sales. They exited four years later with revenue of over $100 million, earning an annual return of about 44 percent.

Medik8’s gross margins exceed 75%, with average net margins around 42 percent, peaking at 57% in 2021. That level of profitability is rare even among premium skincare players.

Source: Making Cents, Iris

As Fallon notes, “Gross margin is the foundation of your earnings power value in consumer products.”

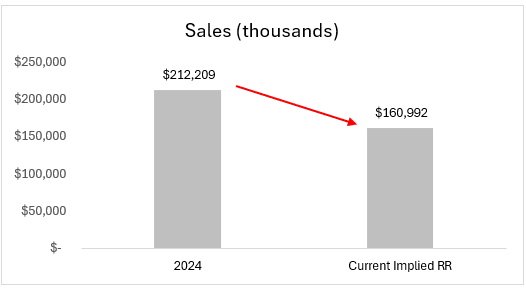

Then there’s Rhode. Fallon’s May 2025 breakdown confirmed that e.l.f. Beauty bought the brand for $1 billion, with most of the payment upfront and the rest tied to future growth. Rhode had made around $212 million in sales in the previous year and was already profitable, which is rare for such a young beauty company. Analysts estimate that e.l.f. paid about four to five times Rhode’s annual revenue, a sign of how much confidence they have in the brand’s staying power.

Post-sale Q2 results that were just released in October. Quarterly sales have leveled off around $40 million, and margins are tightening as the brand expands into retail. There’s no need for alarm bells yet, but it’s clear that the brand’s big challenge will be sustaining momentum without the constant fuel of social media buzz.

Source: Making Cents, Iris

Both cases show why beauty continues to attract some of the highest multiples in consumer goods: outstanding margins and proof that profitability and growth can actually coexist.

Of course, it’s not only about numbers. When you zoom out, these deals tell a bigger story. Beauty giants are building balance into their portfolio.

L’Oréal is cornering the clinical-luxury space. Medik8 slots neatly beside Aesop, Skinceuticals, and Skinbetter Science, making the conglomerate present everywhere from dermatologist offices to luxury counters.

e.l.f. has leveled up from drugstore disruptor to prestige player. After buying Naturium in 2023, Rhode cemented its status as a brand fluent in both TikTok and Sephora.

Unilever’s men’s care lineup has been due for a refresh. With Dr Squatch, it’s getting back some of the edge and relevance that made Axe a phenomenon in its day.

Founders Still Matter

Old-school acquisitions often looked like this: buy the brand, bench the founder, plug it into the machine. Think Coty with Kylie Cosmetics or Estée Lauder with Becca. Once the creative DNA was taken out, the momentum was gone.

Well, now it seems that this model’s dead. In 2025, founders are part of the deal, often literally written into the contract.

Hailey Bieber stayed on as Chief Creative Officer at Rhode. Founder Elliot Isaacs continues to lead innovation at Medik8. Dr Squatch’s leadership remains intact under Unilever.

And that’s because the founder is part of the value. They bring with themselves authenticity and trust that’s an essential part of the brand. In short – you can’t buy a community if you fire the person who built it.

Modern beauty M&A is about amplifying what’s already working. The right founder can keep the soul and purpose of the brand intact. The corporation adds scale, resources, and distribution.

Lessons for Beauty Brand Builders

So what does this mean for the next generation of beauty founders?

You don’t need a VC-sized bank account to matter. What matters now is building something profitable, credible, and ready to scale when the right partner comes along.

Here’s the 2025 blueprint:

1. Know your tempo.

You can be a Rhode – fast, loud, cultural. Or a Medik8 – steady, clinical, compounding. But you can’t be both. Choose a lane and commit.2. Stand for something real.

Science, sustainability, and storytelling are layers that you need to build into your brand. Buyers are looking for proof: real results, transparent practices, and a story that feels organic, not manufactured.3. Build profit into your model from day one.

You don’t need your own lab to act like a CEO. Understand your cost per unit, price for profit, and track what actually sells. That’s how small brands earn big-brand credibility in the eyes of investors and potential partners.4. Build a brand that fills a gap.

It’s all about finding a niche. Be able to explain, in one sentence, what strategic hole you fill in someone’s portfolio. Make yourself easy to justify.5. Keep your founder story alive.

Your name, your face, your voice are part of your brand’s equity. And you don’t have to be a celebrity. That’s your moat.

What’s next

The 2025 acquisitions were built on science, storytelling, and sharp strategy. All cornerstones of building a successful beauty brand. So for now the rules are simple: Build something real. Protect your margins. Cultivate trust.

You don’t need a billion-dollar budget to follow that blueprint. You just need to build something people believe in, run it profitably, and keep your promises. That’s how the next Rhode or Medik8 will start – with a handful of products that actually deliver and a business-savvy founder who cares about the category.

And if you have an idea but need the right product to bring it to life – tell us what you want to build. We’ll help you find the right formula, packaging, and launch strategy so your product hits the market ready to win.

Frequently Asked Questions

-

e.l.f. acquired Rhode for about $1 billion, based on ~$212 million in annual sales. It’s one of the fastest routes to a billion-dollar beauty valuation in history.

-

They proved three things buyers care most about:

• Real consumer demand

• High margins and profitability

• Brand trust and loyalty that isn’t easily replicated

Different speeds, same credibility. -

Buyers aren’t looking for the biggest brands. They’re looking for the strongest foundations.

Small brands win when they stay focused:

• Make a product people love

• Sell it profitably

• Build a community that sticks aroundYou don’t need scale right away. You need proof first.

Must read