Beauty Industry Statistics Every Skincare Brand Should Know Going Into 2026

Table of Contents

Running a skincare brand isn’t just about creating great products or even giving customers a nice experience. That part matters, but it’s not the whole job.

A big part of building a beauty brand today is staying up to speed. Knowing what’s changing. What people are buying now. And figuring out how those changes can actually help your business grow.

You can make decisions based on gut feeling, and sometimes that works. But it’s a lot safer when your choices are backed by data, real industry experience, and a clear view of where the beauty market is heading.

So, let’s look at recent beauty industry statistics and see what they tell us about how the industry is changing, and what that means for beauty brands in the future.

The Global Market Overview 2024 And 2025

Before getting into trends and tactics, it helps to step back and look at the big picture. The beauty industry is a major part of retail and recent beauty industry statistics show that demand is still there, even as shoppers become more selective.

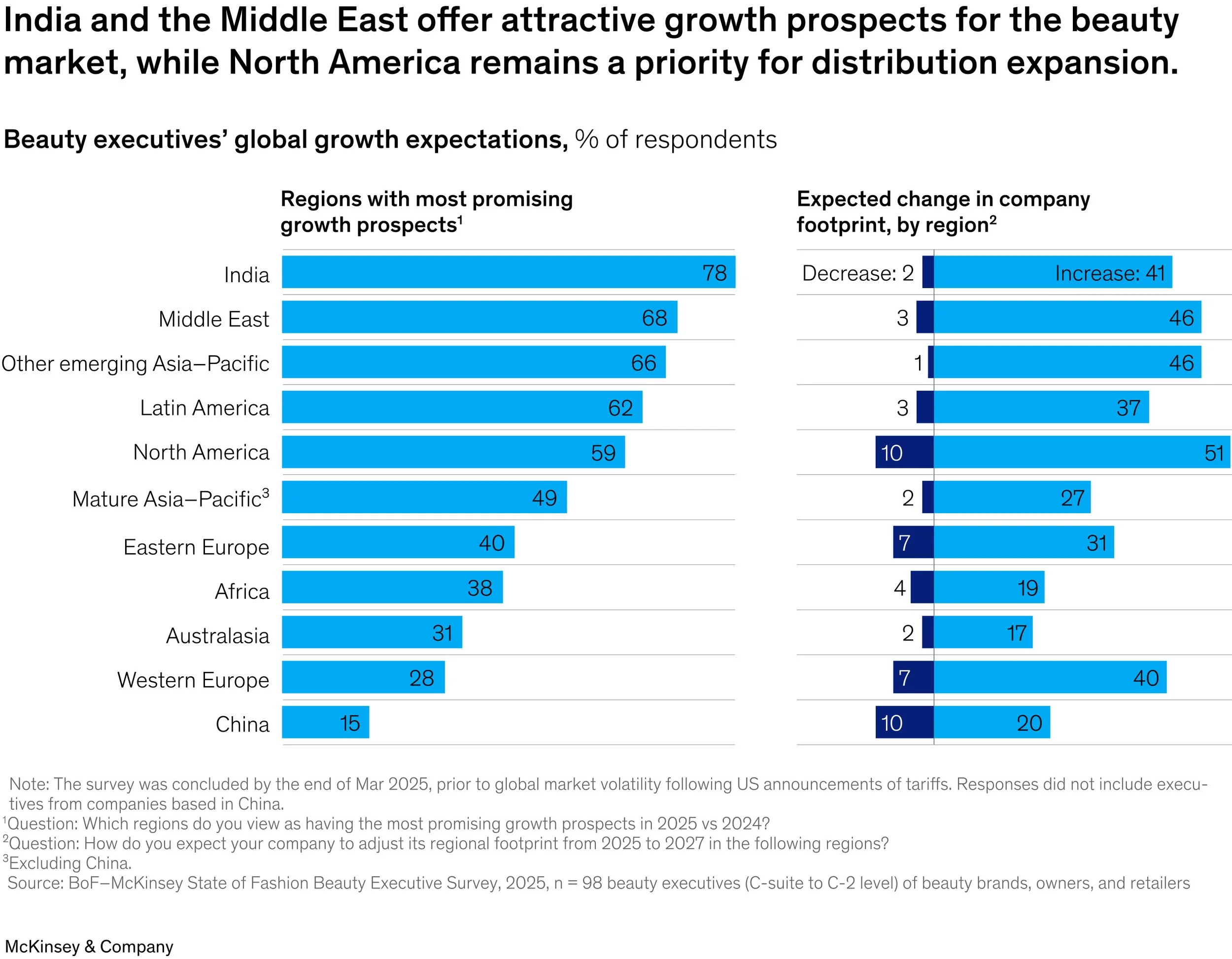

Source: McKinsey & Company

According to a 2025 report by McKinsey & Company, the global beauty industry generated $441 billion in retail sales in 2024 and is expected to grow at around 5% annually through 2030. With skincare making up 41% of total beauty sales. And it’s still holding that position in 2025.

But what matters here isn’t the exact market size. It’s the direction.

Despite inflation and changing consumer behavior, the beauty industry continues to expand. Beauty products remain part of everyday routines, and consumers keep buying – even if they become more selective about pricing, ingredients, and brand value.

Global market beauty stats:

Global beauty industry retail sales in 2024: $441 billion

Annual projected growth rate (2024–2030): ~5%

Share of skincare in total beauty sales: 41%

Skincare’s position in 2025: Still the top category (maintaining the 41% share position)

The Rise of Beauty Ecommerce

If the beauty market is still growing, the next question is where those sales are actually happening? For more and more skincare brands and customers, the answer is simple – online.

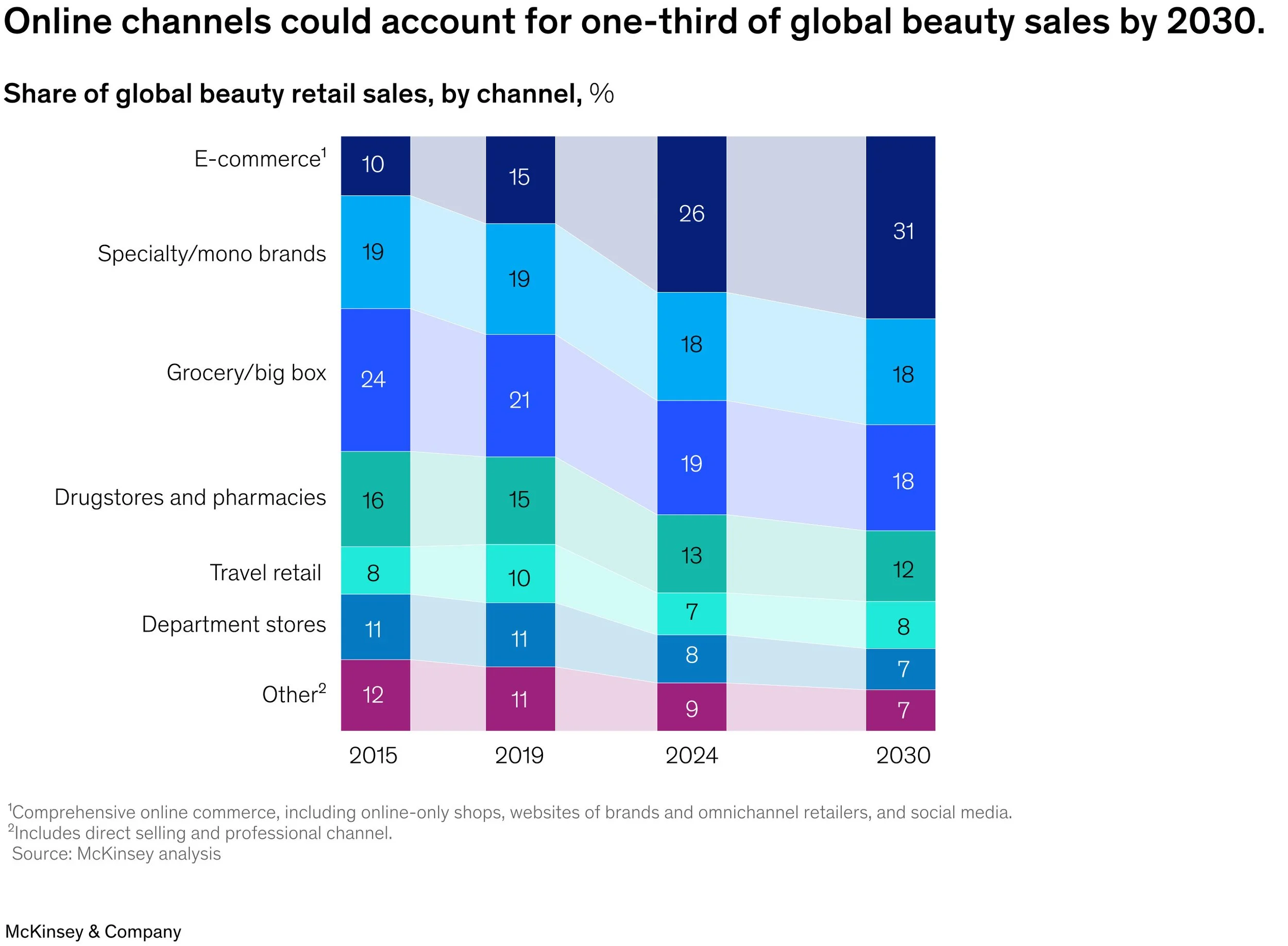

Source: McKinsey & Company

Online shopping has become one of the main ways beauty brands grow, especially in skincare. By 2024, online channels already accounted for 26% of global beauty sales. And over the next few years, that number is expected to keep climbing to the point where ecommerce becomes the biggest sales channel in beauty overall.

In the U.S., digital channels play an even bigger role. NielsenIQ estimates that online purchasing and digitally influenced purchases now account for about 41% of beauty and personal care sales, showing just how central ecommerce has become to how consumers shop for beauty and skincare.

Put simply, this is where the customer attention is moving. More people are discovering, comparing, and buying beauty products online first. For skincare brands, that means ecommerce is where growth, visibility, and customer trust are built.

Ecommerce beauty stats:

Share of global beauty sales happening online in 2024: 26%

Projected trend: Online expected to become the largest sales channel for beauty in the coming years

Share of U.S. beauty & personal care sales from online or digitally influenced purchases: ~41% (NielsenIQ)

Consumer Behavior And Demographics

Beauty shopping has slowed down, but in a good way. Today’s consumers don’t rush into beauty purchases. They research skincare products, read ingredient lists, compare beauty brands, and usually do all of it through online channels before they ever buy.

Source: National Retail Federation

The numbers back this up. During the Thanksgiving holiday weekend, online shopping outpaced in-store shopping across retail and went up by 9% compared to last year, including beauty and personal care. That means most beauty buying decisions now start online.

Much of this shift is being led by younger generations such as Gen Z consumers. According to the Zalando 2025 Beauty Brief, younger shoppers shape demand for skincare, fragrance, and makeup products. They gravitate toward niche brands, expect transparency, and rely heavily on social media marketing instead of traditional ads.

At the same time, shifting demographics are changing the skincare market. Younger shoppers – especially Gen Z along with more men – are becoming a bigger part of the audience. They tend to choose brands that feel approachable, easy to understand, and already present on social media, where much of today’s skincare discovery happens.

The takeaway is clear. Consumer behavior in the global beauty market is more digital, more informed, and more values-driven than ever. And beauty brands that adapt to that reality are the ones pulling ahead.

Consumer behaviour beauty stats:

Online shopping growth during Thanksgiving weekend (year-over-year): +9%

Trend insight: Online shopping outpaced in-store shopping across retail, including beauty and personal care

Generational influence: Gen Z identified as a major driver of demand in skincare, fragrance, and makeup (Zalando 2025 Beauty Brief)

Demographic shift: Increasing beauty and skincare participation from younger shoppers and men

Skincare Trends Shaping The Beauty Market

Skincare keeps leading the global beauty market. Beauty shoppers are thinking more about skin health in general, not just how their skin looks on a good day.

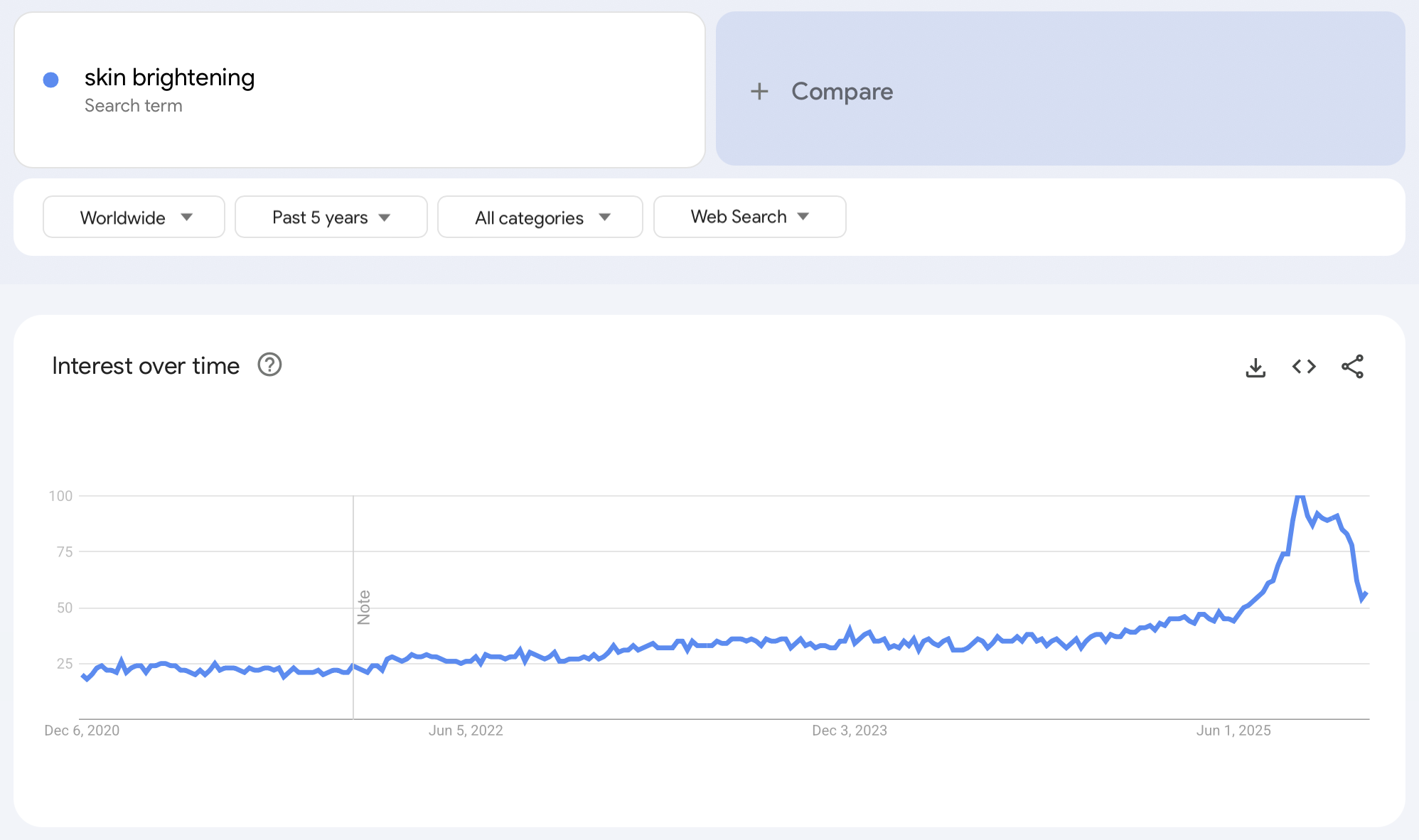

Instead of relying on quick cosmetic fixes, consumers are putting more focus on results that actually last. You can see that mindset shift in what people search for. For example, interest in skin brightening has nearly tripled over the past five years and hit its highest point in 2025. That kind of growth means people want even tone, clarity, and healthy-looking skin.

Source: Google Trends

The same thing shows up in ingredient choices. Vitamin C, niacinamide, and other skin-health ingredients keep becoming part of everyday routines because they work over time and make sense for daily skincare.

That focus shows up in the numbers, too. Skincare makes up about 41% of global beauty sales, which puts it well ahead of other categories. Hair care sits closer to 21%, while makeup and fragrance are each around 19%. Skincare is simply the biggest slice of the pie.

And the reason is simple. People might skip a lipstick launch or hold off on a new fragrance, but they don’t usually stop buying the skincare products they rely on. Those daily habits are why the skincare market stays more stable, and why it continues to be one of the strongest growth areas for beauty brands.

Beauty trend stats:

Search interest in skin brightening: Nearly tripled over the past five years, reaching its highest point in 2025

Skincare share of global beauty sales: ~41%

Hair care share: ~21%

Makeup share: ~19%

Fragrance share: ~19%

Sustainability And Ethical Beauty Demand

Sustainability and ethical decision isn’t a side conversation in beauty anymore. It’s something customers actively look for. You can see it clearly in the growth of vegan products and cruelty-free beauty.

The vegan cosmetics market reached $19.21 billion in 2024 and is expected to grow to $20.48 billion by the end of 2025, showing rising consumer demand for vegan products, cruelty-free formulas, and natural ingredients.

Packaging itself has become a big part of the decision as well. In the U.S., 77% of consumers say recyclability matters a lot to them when they think about sustainability. For many customers, sustainable packaging is now part of what defines a “good” brand – especially when they’re buying premium skincare products.

For beauty and skincare companies, this isn’t always easy. Customers want sustainable beauty products, but they still care about results and competitive pricing. What seems to work best right now are brands that make products do their job, price them fairly, and are honest about what they stand for.

Ethical beauty stats:

Vegan cosmetics market size in 2024: $19.21 billion

Projected vegan cosmetics market size in 2025: $20.48 billion

Share of U.S. consumers who say recyclability is important in sustainability decisions: 77%

Innovation And Tech in Skincare Industry

As more beauty shopping happens online, the way people choose products is changing along with it. Technology has become part of the buying process, especially for skincare and cosmetics, helping consumers feel more confident before purchase.

The beauty tech market jumped from about $68.9 billion in 2024 to $79.4 billion in 2025, which is a huge leap in just one year. Significant growth like that usually comes from real demand, and in this case it’s driven by consumers wanting more personalized products, cleaner beauty options, and better online tools that actually help them choose.

What’s driving this shift is how quickly technology is getting woven into everyday beauty routines. Beauty and skincare customers want help choosing the right beauty products, that’s why more beauty brands are using tools like AI-powered skin analysis or ingredient insights to explain what a product does and who it’s for.

The simple takeaway? Technology doesn’t replace good products. It makes them easier to trust. Brands that use tech to educate, guide, and simplify the buying experience are the ones building stronger relationships with their customers.

Beauty tech stats:

Beauty tech market size in 2024: $68.9 billion

Beauty tech market size in 2025: $79.4 billion

Year-over-year growth of the beauty tech market (2024 → 2025): +$10.5 billion

What Beauty Industry Statistics Mean for Brands

When you step back and look at the beauty statistics, it’s clear the market is changing. So, these beauty stats give a pretty good preview of what beauty industry statistics 2026 and beyond are likely to look like.

One of the biggest growth opportunities is still ecommerce. Online sales keep climbing, which means digital platforms and modern distribution channels are now central to any beauty brand’s growth strategy.

At the same time, younger consumers are moving the industry forward. They set key trends, care about brands creating a positive impact, and respond best to smart, honest digital marketing. So, keep them in mind.

For beauty brands, priorities going forward are pretty simple:

focus on long term growth;

use key statistics to guide decisions;

build clear, simple customer journeys across online channels.

Of course, none of this comes without challenges. Competition is heavy, compliance rules are tighter, sustainability claims need to be real, and supply chains can still be unpredictable.

But the brands that pay attention to the right numbers and stay grounded while they grow are the ones most likely to become true industry leaders. Be one of them!

How to Use Data Strategically as a Brand

Beauty industry statistics help beauty companies understand what’s actually happening in the global beauty market. So the smartest of them use data to guide focus. They track key statistics across categories like the skincare market, hair care, and makeup products to see where market share is moving and which product offerings make sense next.

And data is most useful when it leads to action, so:

spot key trends early, especially among younger generations and Gen Z consumers;

adjust pricing and positioning to stay competitive without losing brand value;

back decisions on sustainable beauty products, vegan products, and natural ingredients with real numbers;

measure what actually drives beauty sales.

The real advantage comes from turning numbers into decisions. In a global beauty and cosmetics market this competitive, brands that use data to stay focused are the ones built for long term growth.

A New Reality for Beauty Brands

The biggest key takeaways from these beauty stats are simple – the market is still moving forward, but it’s moving with intention. Growth now belongs to brands that pay attention, stay curious, and adapt in real time.

Beauty brands that use data to guide decisions are the ones set up to grow significantly. When you understand your customer, respect what they care about, and build with the long term game in mind, momentum follows.

Must read